Project

AYA Mobile Banking

Role

UX Designer

TImeline

6 Weeks

tools

Figma

Impact

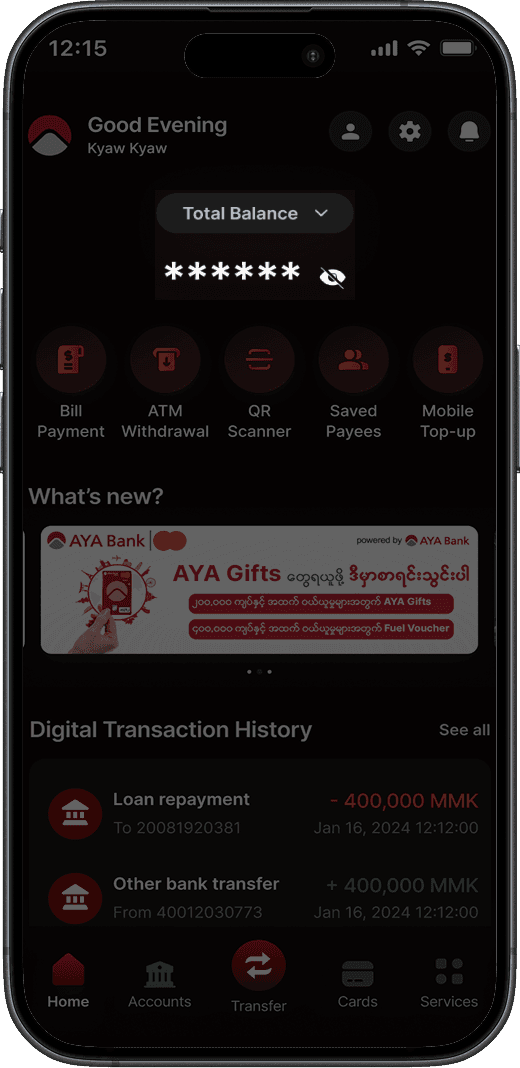

Through a complete redesign of AYA Mobile Banking’s core banking flows, we reduced transaction time by rough half, simplified user journeys across key tasks, and increased overall task completion rates.

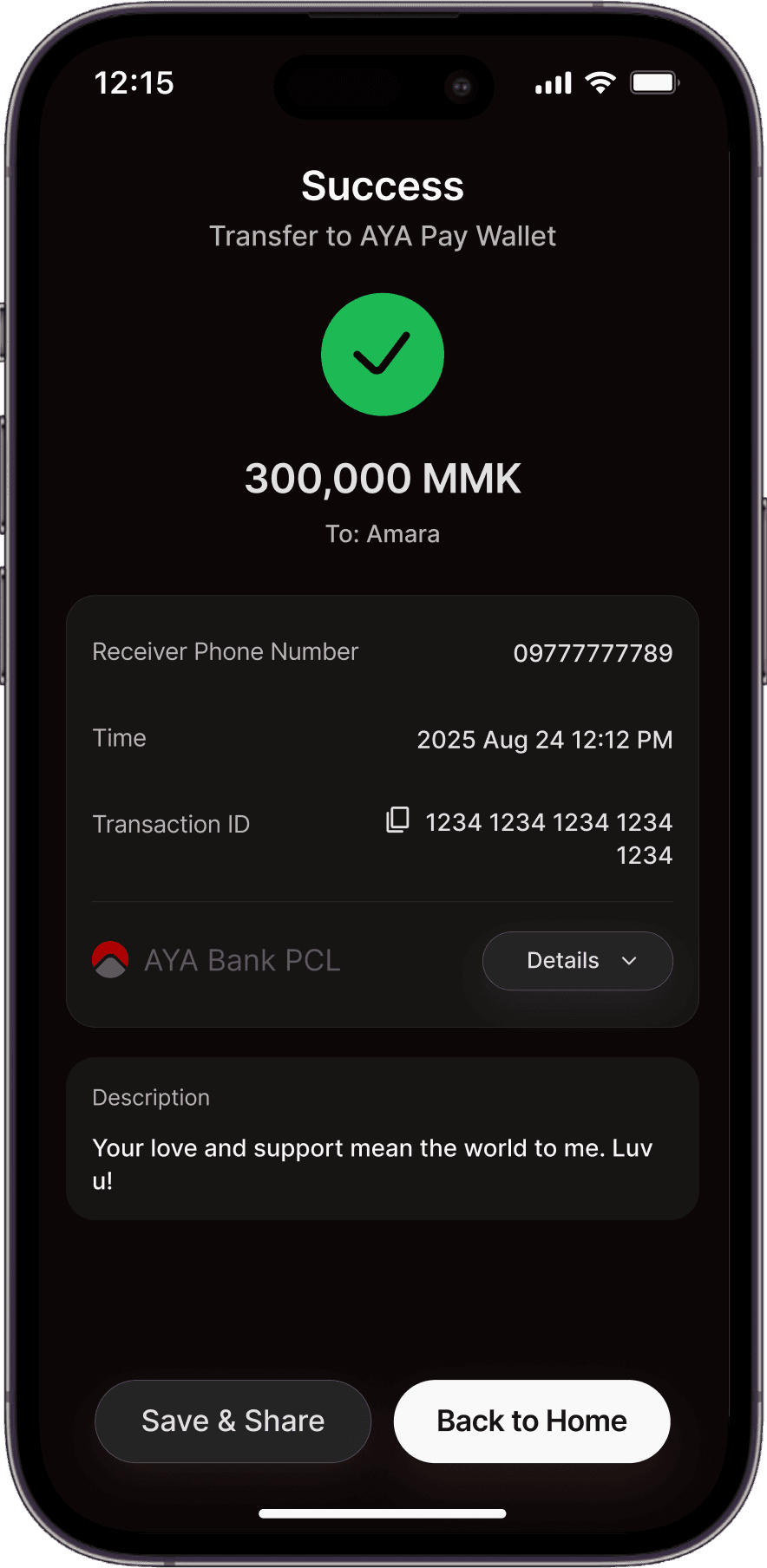

With new features like Transfer to Wallet and enhancements to Loan Repayment, the new AYA Mobile Banking platform distinguishes itself from the previous version, driving higher user engagement and attraction.

These enhancements contribute to a seamless experience across the AYA ecosystem and promote safe, positive financial habits.

Pain Points

After conducting user interviews with 6 mobile banking users in Myanmar between the ages of 25 and 45, a competitor analysis with 6 banking apps, and a usability audit, we uncovered frustrations and recurring pain points, which provided valuable insights that guided design decisions.

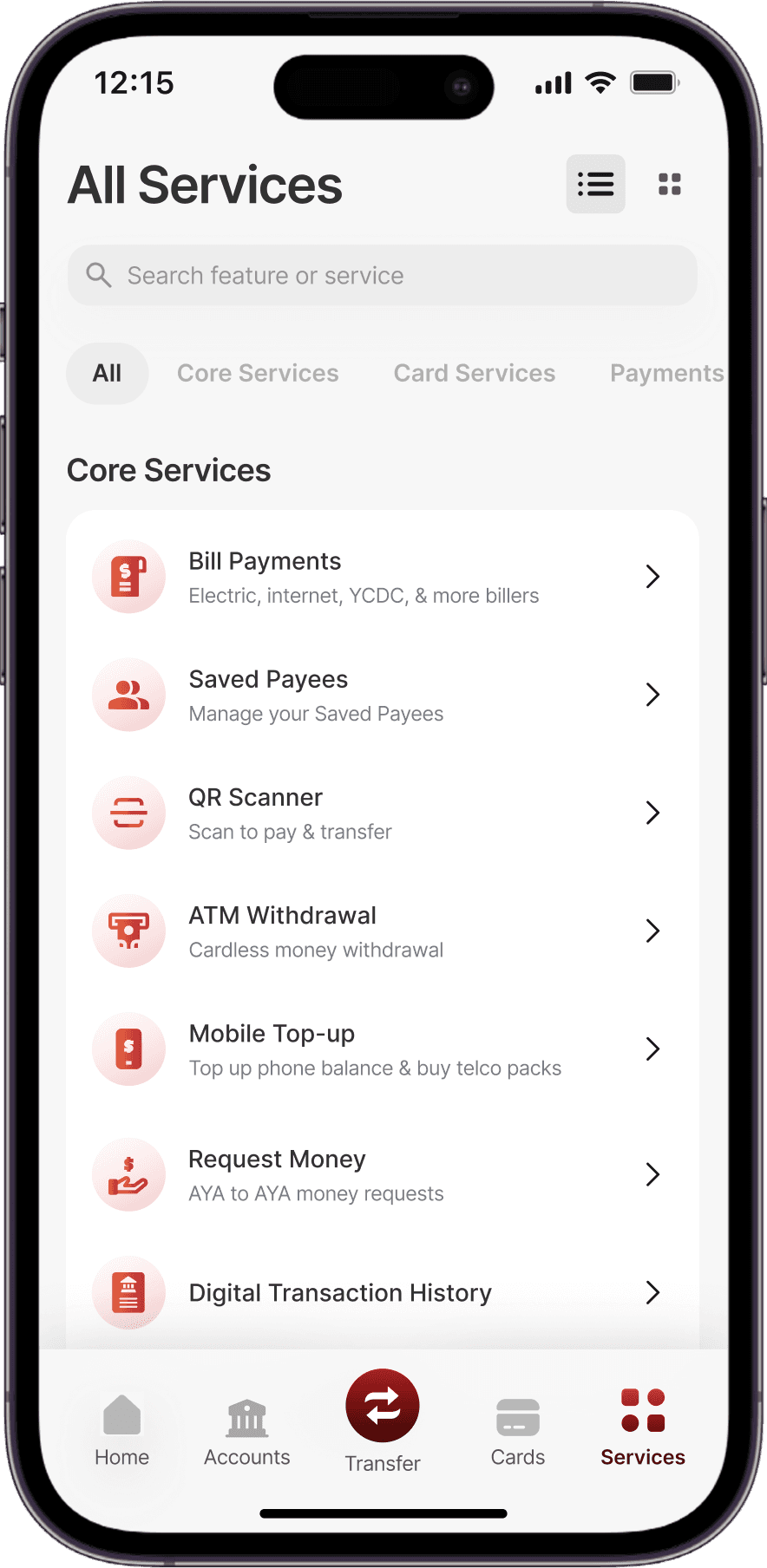

Confusing IA

During tasks, users spent about 30% of the time in the main menu locating the relevant feature due to unclear labels and poor organization.

80% of users struggled to return to the home page after finishing a task due to lack of a clear path.

Low Awareness

Most participants unaware of Fast Pay and Personal Financial Management, resulting underutilized services.

50% of participants were not aware about the distinction between Interbank and Fast Interbank features.

Confusing labels and similar-sounding feature names caused users to hesitate or make wrong choices.

Low Accessibility

Small text and touch targets caused accessibility issues for users, especially older folks and those with sight issues.

Weak visual hierarchy makes difficult for users to scan and spot important information quickly.

All users perceived the app as outdated and less trustworthy due to outdated UI design.

Slow Task Completion

All users found the SMS OTP authentication unreliable, reporting frequent delays that slowed down transfers.

Since bank accounts were represented only by account numbers, users took longer to choose payment account during transfers compared to competitor platforms.

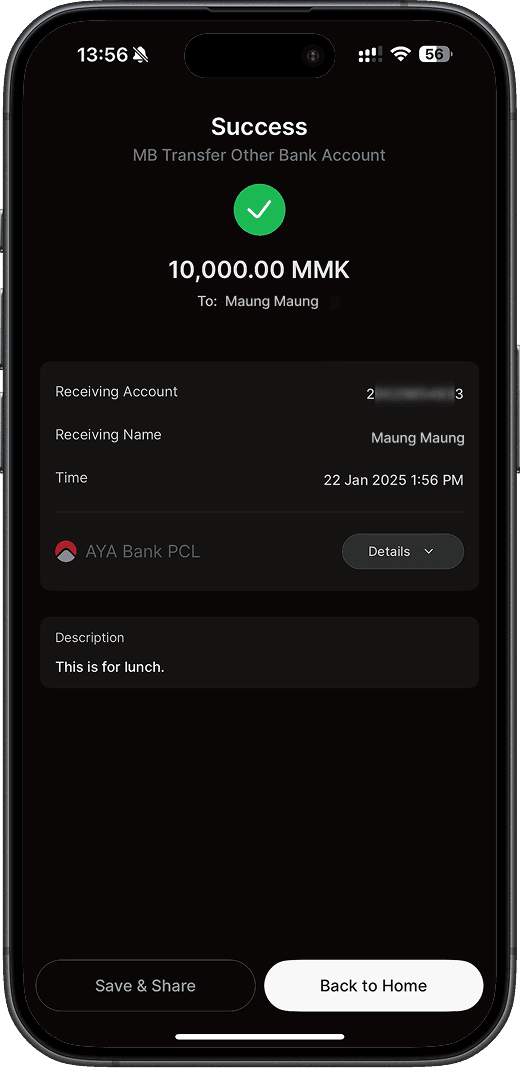

Loan repayment process was fragmented and lengthier than competitors platforms.

Strategy & Solutions

To address the most critical pain points, we reimagined the AYA Mobile Banking experience through four core strategic pillars: guide users through intuitive navigation, help users finish tasks quickly, drive effortlessness, and build trust.

Navigation |

Unify fragmented features & Streamline User Journeys |

drive effortless interactions |

Build trust & Usability through accessible UI |

Outcome

Redesigning everyday essential tasks that form the core of the AYA Mobile Banking app not only improved usability and accessibility, but also strengthened AYA’s brand perception as a trusted, user-first bank. This redesign shows how thoughtful UX can drive adoption and satisfaction of digital banking. This project deepened my understanding of designing for diverse digital literacy levels and the importance of aligning UX with cultural context.